Understanding Credit Finance: A Comprehensive Guide

Introduction to Credit Finance

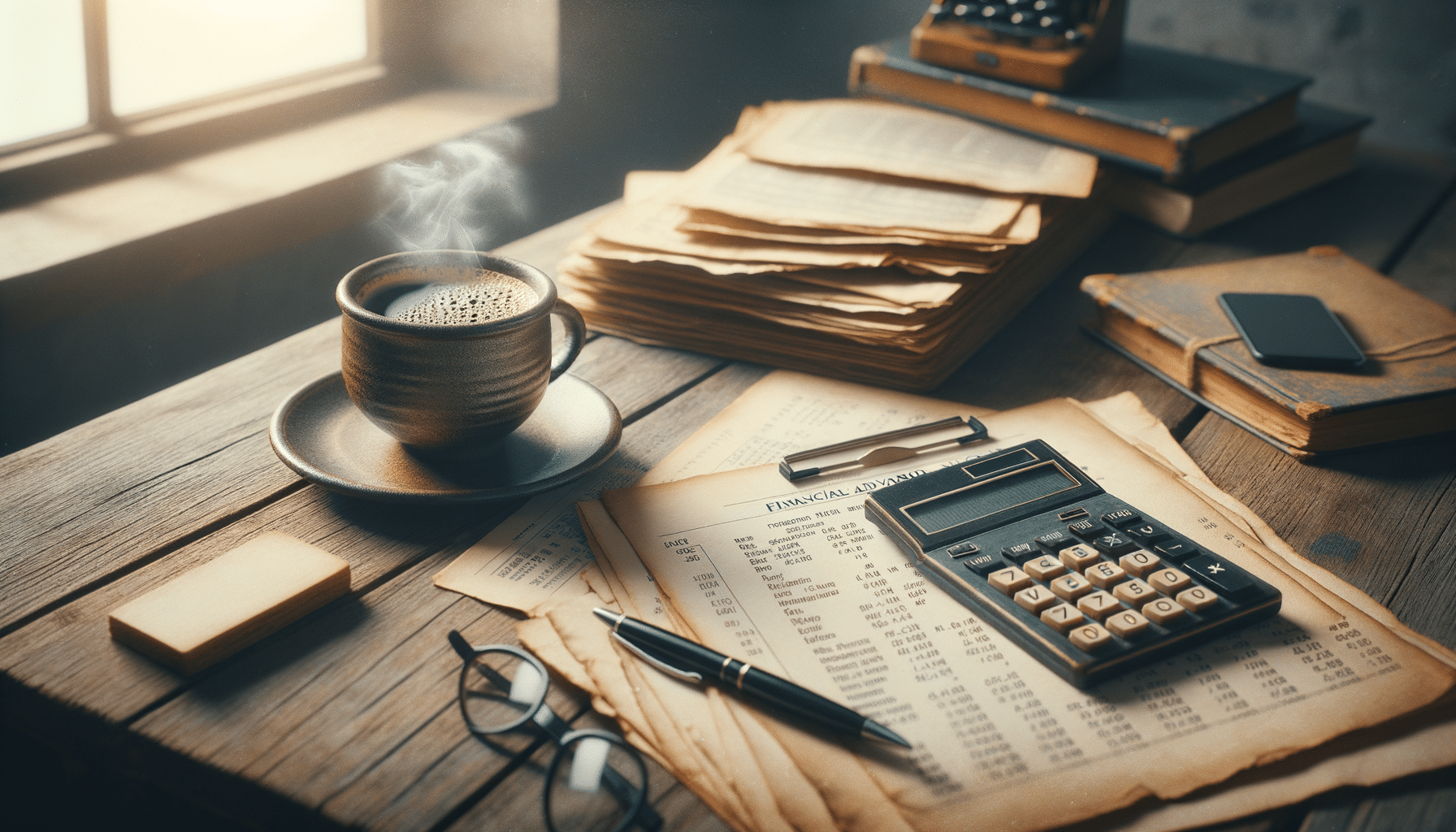

Credit finance plays a pivotal role in the global economy, influencing how individuals and businesses manage their finances. It encompasses various forms of credit, including loans, credit cards, and lines of credit, each serving different purposes. Understanding credit finance is crucial as it affects our daily lives, from purchasing homes to managing business operations.

At its core, credit finance involves borrowing money with the agreement to repay it over time, usually with interest. This system allows consumers to make significant purchases and businesses to expand operations without requiring immediate full payment. The importance of credit finance cannot be understated, as it provides the necessary liquidity and flexibility in financial planning.

In this article, we will delve into the various aspects of credit finance, exploring its types, benefits, challenges, and the impact it has on economic growth. We will also provide practical insights into how individuals and businesses can effectively manage their credit to achieve financial stability.

Types of Credit Finance

Credit finance can be broadly categorized into three main types: installment credit, revolving credit, and open credit. Each type serves distinct purposes and comes with its own set of advantages and considerations.

Installment Credit: This type involves borrowing a specific amount of money and repaying it over a predetermined period with fixed payments. Common examples include mortgages and auto loans. The predictability of installment credit makes it a popular choice for large purchases.

Revolving Credit: Unlike installment credit, revolving credit provides borrowers with a credit limit that can be used repeatedly, as long as the balance is paid off. Credit cards are the most common form of revolving credit, offering flexibility but often at higher interest rates.

Open Credit: This is less common and typically involves accounts that need to be paid in full each billing cycle, such as utility bills. Open credit does not have interest charges but requires timely payments to avoid penalties.

Understanding these types helps in choosing the right credit option based on financial needs and repayment capabilities.

Benefits and Challenges of Credit Finance

Credit finance offers numerous benefits, making it an essential tool for both consumers and businesses. However, it also presents challenges that need careful management.

On the benefits side, credit finance allows individuals to make significant purchases without waiting to save the entire amount. It also enables businesses to invest in growth opportunities and manage cash flow effectively. Additionally, responsible credit use can enhance credit scores, leading to better borrowing terms in the future.

However, credit finance comes with challenges, primarily the risk of accumulating debt. High-interest rates, especially on credit cards, can lead to substantial financial burdens if not managed properly. Additionally, excessive reliance on credit can affect credit scores negatively, making future borrowing more difficult and expensive.

Balancing the benefits and challenges of credit finance requires disciplined financial management and a clear understanding of one’s financial situation.

Impact of Credit Finance on Economic Growth

Credit finance is a catalyst for economic growth, facilitating consumer spending and business investments. By providing liquidity, credit finance enables more significant economic activities, leading to job creation and increased production.

For consumers, access to credit means they can purchase homes, cars, and other goods, stimulating demand in the economy. Businesses, on the other hand, use credit to fund expansions, invest in new technologies, and enter new markets, driving innovation and competitiveness.

However, the impact of credit finance on economic growth is not without risks. Over-leveraging by consumers or businesses can lead to financial instability, as seen in past economic crises. Thus, a balanced approach to credit finance is crucial to sustain healthy economic growth.

Policymakers and financial institutions play a vital role in ensuring that credit finance contributes positively to the economy by implementing regulations and offering financial education to promote responsible borrowing and lending practices.

Managing Credit Finance Effectively

Effective management of credit finance is essential for financial health and stability. It involves understanding credit terms, maintaining good credit scores, and avoiding excessive debt.

Here are some strategies for managing credit finance effectively:

- Budgeting: Create a detailed budget to track income and expenses, ensuring that there is enough to cover monthly credit payments.

- Monitoring Credit Reports: Regularly check credit reports for accuracy and to understand how credit behaviors impact credit scores.

- Paying on Time: Timely payments are crucial for maintaining a good credit score and avoiding late fees and penalties.

- Limiting Credit Use: Avoid using credit for non-essential purchases, and aim to keep credit utilization below 30% of the credit limit.

- Seeking Professional Advice: Consider consulting financial advisors for personalized strategies to manage and improve credit health.

By adopting these practices, individuals and businesses can harness the benefits of credit finance while minimizing its risks, paving the way for financial success.